💡 A “backdoor” Roth IRA strategy is a personal finance hack that allows high-income earners to bypass direct Roth IRA contribution limits. The strategy is 2 easy steps (expanded upon for clarity below): 1. Make an after-tax Traditional IRA contribution & leave it in cash. 2. Quickly complete a Roth Conversion, investing the converted dollars for growth.

You are performing a Roth Conversion which is a taxable event. Done properly, this process will produce $0 in tax liability. ❗

🖋️Editor’s Note: MaxmyRoth.com’s would like to recognize Dr. James M. Dahle, WCI Founder, for providing the best explanation of this process on the internet.

Why you should use the “Backdoor” Roth IRA Process

MaxmyRoth loves Roth IRAs & Roth dollars (tax-free growth and distributions). You should too!

Who should use the “Backdoor” Roth IRA Process

The “Backdoor” Roth IRA process should only be used by “High-Income Earners” being phased out of the ability to make direct Roth IRA contributions.

| Maximum direct Contribution for individuals 0-49 yrs old | Maximum direct Contribution for individuals age 50+ | Single Filers Income (MAGI) | Married Filing Jointly Income (MAGI) | Married Filing Separately Income (MAGI) |

| $6,000 | $7,000 | under $129,000 | under $204,000 | $0 |

| $5,400 | $6,300 | $130,500 | $205,000 | $1,000 |

| $4,800 | $5,600 | $132,000 | $206,000 | $2,000 |

| $4,200 | $4,900 | $133,500 | $207,000 | $3,000 |

| $3,600 | $4,200 | $135,000 | $208,000 | $4,000 |

| $3,000 | $3,500 | $136,500 | $209,000 | $5,000 |

| $2,400 | $2,800 | $138,000 | $210,000 | $6,000 |

| $1,800 | $2,100 | $139,500 | $211,000 | $7,000 |

| $1,200 | $1,400 | $141,000 | $212,000 | $8,000 |

| $600 | $700 | $142,500 | $213,000 | $9,000 |

| Only indirectly through the “backdoor” | Only indirectly through the “backdoor” | $144,000 & over | $214,000 & over | $10,000 & over |

While we love the “Backdoor” Roth IRA strategy to juice Roth IRA values, if your income falls in the first row of the above table you should contribute directly to a Roth IRA and skip this entire process.

The 5 “Backdoor” Roth IRA Timing Factors – The When?

1️⃣ IRA Contribution Deadline

All IRA contributions (SEP, SIMPLE, Traditional & Roth) for a given tax year must take place between January 1st of the tax year and April 15th of the following year.

❗Tax filing extensions do not extend your ability to make IRA contributions. ❗

2️⃣ Roth Conversion Deadline

The “Backdoor” Roth IRA process hinges on the concept of a Roth Conversion. A Roth conversion can happen at any point during the calendar year. But, you must complete the Roth Conversion by December 31st of the current calendar year to report the conversion for that taxable year.

For Example: in order to record a Roth conversion for the taxable year 2022, the conversion must be completed by Dec. 31, 2022.

Follow these steps to do Roth Conversion using Turbo Tax.

3️⃣ “Backdoor” Roth Conversion Deadline

There is no literal deadline for a “Backdoor” Roth Conversion different than what is described above.

I am giving you one.

DEADLINE = After-Tax IRA Contribution date + 1

There are 4 good reasons this should be your deadline:

The faster you Roth Convert the faster your $6,000 is achieving tax-free compound growth.

You DON’T have to remember to do something on 2 different dates. Just. Get. It. Done.

You have a ~100% chance of having any unnecessary tax liability from this process. $0 taxable income will be reported.

Your paperwork filing process will require less brain power.

There is NO good reason to perform the Roth conversion step of the “Backdoor” Roth IRA process (step 3 below) other than immediately after the IRA contribution is made (step 1).

4️⃣ Do this every year for both you and your spouse.

5️⃣ The Roth Conversion 5-Year Rule

When performing a Roth conversion you must wait 5 years (the clock starts Jan 1st) before you can access the principal value (contribution value, basis, converted value) without a 10% early withdrawal penalty.

Confusingly, there is a superseding exception to the 10% early withdrawal penalty, on contributions, where once you reach age 59.5 the penalty no longer applies. To further complicate things, generally, Roth contributions avoid the 10% early withdrawal penalty but this only applies to direct Roth IRA contributions. Roth Conversions are treated differently.

Growth on the principal value (earnings) is subject to a separate and different 5-year rule.

This mostly affects early retirees. It’s best to illustrate with some examples:

- You retire at the age of 60 and perform your 1st Roth Conversion:

- Because you are older than 59.5 you are not subject to the 5-year Roth Conversion Rule & are immune to the 10% early withdrawal penalty.

- You retire at the age of 50 and perform your 1st Roth Conversion:

- You are subject to the 5-year Roth conversion rule. Distributions from the principal value of the Roth Conversion can be withdrawn penalty-free at age 55. Any growth above the Roth Converted dollar value will be subject to a 10% early withdrawal penalty until you reach age 59.5 because of the superseding penalty.

- You retire at the age of 57 and perform your 1st Roth Conversion:

- You are not subject to the 5-year Roth conversion rule. You are subject to the age 59.5 10% early withdrawal penalty. Distributions from the principal value of the Roth Conversion can be withdrawn penalty-free at age 59.5. Growth above the Roth Conversion principal may also be penalty-free at age 59.5 assuming you have had SOME Roth IRA open for 5 years.

Executing the “Backdoor” Roth IRA Process

🖋️ Editor’s Note: MaxmyRoth.com’s #1 goal is to provide educational information that provides you with the best chance of getting the largest amount of accumulated wealth exposed to tax-free growth and untaxed distributions. The order and details of the steps below represent our view on how to accomplish that best.

😿Meet Sad Cat. Sad Cat has made an actual error during the “Backdoor” Roth IRA process. Look for Sad Cat as we move through the steps so you can avoid the errors it makes. We will help fix Sad Cat’s errors at the end of this article.

Step 1: Make an After-Tax Traditional IRA contribution

Make the maximum $6,000 ($7,000 if 50+) nondeductible Traditional IRA contribution for both you and your spouse (even if non-earning). Do it by January 5th.

🤓Nerd Note:

What does making a non-deductible Traditional IRA contribution actually mean?

nondeductible = after-tax = post-tax are used interchangeably. They all refer to money that has already been taxed.

We need to place after-tax money into a “pre-tax” account - a Traditional IRA via a non-deductible contribution.

Traditional IRAs are “pre-tax” accounts because you get an immediate (current year) tax deduction for the contributions made to them. This occurs when you file your taxes. You subtract the value of the contribution against your taxable income - reducing your total tax liability.

To affect a non-deductible contribution we do not claim the available deduction when filing taxes.

You want that sweet sweet tax-free compounding. The sooner you start the sooner the remaining steps can complete and grow your Roth IRA value.

Avoid making the following “mistakes” that will likely result in less Roth IRA value!

1. Contributing anything less than the maximum

2. Forgetting to contribute to each spouse’s (even if non-earning) Roth IRA.

3. Waiting until later in the year to make your contribution

😿 Sad Cat contributed directly to a Roth IRA, instead of to a Traditional IRA because it did not realize it was a “high-earner”.

Step 2: Leave the nondeductible contribution in cash

Keep the $6,000 ($7,000 if 50+) non-deductible Traditional IRA contribution in cash.

You have already paid tax on the non-deductible contributions. The same can not be said for the growth those dollars achieve. Growth on non-deductible contributions produces taxable income when performing step 3.

😿 Sad Cat did not listen to us & chose to invest in the double-leveraged “Eloncoin” Exchange Traded Fund. It did not know it was coming down with a bad case of food poisoning, leaving it incapacitated for the next 3 weeks & delaying the implementation of step 3.

Step 3: Perform a Roth Conversion on the $6,000 nondeductible Traditional IRA contribution

If you don’t have a Roth Individual Retirement Account at a financial institution (Fidelity, Schwab, Etc.) you will need to create one before performing this step.

Perform a Roth Conversion by transferring $6,000 from your non-deductible Traditional IRA to your Roth IRA. Feel free to call your IRA Custodian/Trustee if you want to be coached through this process further.

😿 Sad Cat got swept up in all the important things cats do in life. Sad Cat forgot to perform the Roth Conversion during the contribution calendar year.

Step 4: Invest the converted funds ASAP inside the Roth IRA

If you want your Roth IRA to grow as much as possible, invest the cash now in your Roth IRA as quickly as possible. Invest as aggressively as your risk tolerance & risk capacity will allow for. Get more tips and strategies here.

Investing should be able to happen the same day, or as soon as the funds “Settle”.

😿 Sad Cat got swept up in all the important things cats do in life. Sad Cat forgot to invest the newly converted $6,000 now inside its Roth IRA.

Step 5: Avoid the IRA Aggregation Rule Via Isolated Rollovers

No IRA stands alone. Tax law stipulates that when determining the tax consequences of an IRA distribution – the value of all Non-Roth & Non-Inherited IRA accounts will be aggregated together for any tax calculations. This is known as the IRA aggregation rule.

Roth Converting is a taxable event. It requires us to calculate the amount of taxable income we will recognize on our Income Tax return.

Our taxable event is the “Backdoor” Roth conversion where we will generate ~$0 income tax because we are recovering 100% of our nondeductible IRA basis (more on this in the next section of the article).

We must apply the IRA aggregation rule to any SIMPLE, SEP, & Traditional IRA values. The “pro-rata” rule portion of the IRA aggregation rule cares about 1 day. December 31st. On December 31st we must have a $0 balance across all SEP, SIMPLE, and Traditional IRAs to avoid our Roth Conversion becoming pro-rated. Pro-rating a Roth Conversion eliminates most of the benefits of the “Backdoor” Roth IRA process.

The “event” will generate $0 in tax liability because you will be recovering $6,000 worth of IRA basis created when you made your nondeductible contribution. We will cover exactly how to recover your basis in Step 6.

An example will help:

On November 1st John and Jane check all of their investment account statement balances….

Vanguard SEP IRA (John)- $0 ✅

Fidelity SIMPLE IRA (John) – $0 ✅

Schwab Jt. Taxable – $100,000 ✅

Fidelity SIMPLE IRA (Jane) – $70,000 ✅

Fidelity Traditional IRA (John) – $0 ✅

Fidelity Inherited IRA (John) – $9,000 ✅

Fidelity Roth IRA (John) – $100,000 ✅

Fidelity 403(b) (Jane) – $250,000 ✅

Schwab Solo 401(k) (John) – $300,000 ✅

We are trying to perform a Roth Conversion this calendar year, for John. Each account “clears” the “Pro-Rata” rule. It does so because the “Pro-Rata” rule only cares about SIMPLE, SEP, and Traditional IRAs with respect to John as an individual. The Jt. account, 403(b), Solo 401(k), Jane’s SIMPLE, John’s Roth IRA, & John’s Inherited IRA are all excluded from consideration. John has a $0 balance across his SIMPLE, SEP, and Traditional IRA. John’s Roth Conversion will not be pro-rated as long as these balances REMAIN $0 on December 31st.

One more example should crystalize this:

On November 1st John and Jane check all of their investment account statement balances….

Vanguard SEP IRA (John)- $0 ✅

Fidelity SIMPLE IRA (John) – $0 ✅

Schwab Jt. Taxable – $100,000 ✅

Fidelity SIMPLE IRA (Jane) – $70,000 🚫

Fidelity Traditional IRA (John) – $0 ✅

Fidelity Inherited IRA (John) – $9,000 ✅

Fidelity Roth IRA (John) – $100,000 ✅

Fidelity 403(b) (Jane) – $250,000 ✅

Schwab Solo 401(k) (John) – $300,000 ✅

We are trying to perform a Roth Conversion this calendar year, for Jane. Now we have a problem. Jane does not have a $0 balance across her SIMPLE, SEP, and Traditional IRA due to the $70,000 SIMPLE IRA. Jane needs to roll over her $70,000 Fidelity SIMPLE IRA to her 403(b) if it will allow rollover contributions. Alternatively, she can create an Individual 401(k) through self-employment and roll her SIMPLE IRA there. If she does not complete the rollover Jane’s “Backdoor” Roth Conversion step will be “pro-rated”.

We will go more in-depth on the pro-ration reporting during the tax reporting section.

😿 Sad Cat forgot it had an old Vanguard custodied SEP IRA with a $100,000 balance on December 31st in his Roth conversion year.

👉 PRO TIP: Almost anyone, including non-resident aliens, with Net Profit (IRS Schedule C, Line 31) can create a Solo 401(k). All you need is an Employer Identification Number for the Individual 401(k) retirement trust. Keep it simple. An easy business that will earn a small net profit. For example, affiliate link income on a niche blog site. Zero expenses, small income = Net Profit to establish a Solo(k). It must be a sustainable business. It can’t be a hobby business.

🎉 You have successfully executed the “Backdoor” Roth IRA Process 🎉

unfortunately, now you have to report execution steps 1 & 3 to the IRS, or you might be paying lots of extra unnecessary tax!…….

Tax Reporting for the “Backdoor” Roth IRA Process

Come April 15th you will be preparing your tax returns for the previous calendar year. You are, just now, reporting a process you “finished” 14.5 months earlier (less if you made mistakes along the way)! It is no wonder many folks mess this entire strategy up. I can’t remember much from last week, let alone over a year ago!

Step 1: Obtain Form 1099-R from your IRA Custodian/Trustee

The IRS requires IRA Custodian/Trustees to fill out & send form 1099-R by January 31 in the year following distributions of $10 or more.

Your current Tax Filing Year “Backdoor” Roth IRA Conversion will generate a Form 1099-R from the custodian where your non-deductible contributions were deposited (Fidelity, Etc.). You should be able to download a copy online. Many Trustees still physically mail these bad boys.

🤓 Nerd Note:

Custodians/Trustees are usually giant Financial Institutions like Fidelity, Charles Schwab, Etc., but many modern financial institutions are simply a fancy technology wrapper around the true custodian. Custodian-as-a-service if you will. One example is Apex Clearing, which is the custodian of record for many financial firms including Altruist, SoFi, Etc.

.jpg?id=dade858b-d44e-4366-9af4-088e23d66250&table=block&spaceId=ee977e32-e5a5-4ba7-8b22-58be88109fac&width=960&userId=fe66e669-9478-431c-9da2-626118af70f2&cache=v2)

Form 1099-R, box 1, will report a gross distribution of approximately $6,000 (the amount of the Roth IRA conversion). The above example assumes the execution steps of the “Backdoor” Roth IRA conversion were done in the “maximized” way.

Form 1099-R, box 2a, is where the taxable amount of the Traditional IRA distribution is listed from the perspective of the custodian of the account (Fidelity, Etc.). Because the custodian does not actually know how much of the distribution will be taxable to you, to cover their butt’s from a compliance perspective, they will usually put the total amount you distributed.

To de-risk themselves, custodians will check the left tick of 1099-R, box 2b – “Taxable amount not determined”.

This box indicates to the IRS that the financial institution can not determine how much of the distribution being reported is taxable with the knowledge they have. When this box is checked it is indicating the participant should file form 8606 and use the info to populate IRS form 1040.

When the 1099-R shows >$6,000 in box 2a

Despite One’s best efforts, you may have growth on your $6,000 non-deductible contribution. It could be .50 cents, it could be $1.00, or it could be $1,000 bucks.

If you contributed $6,000 for the calendar year and distributed $6,120 3 months later (because of growth on the investments in the account) they would put $6,120 in box 2a.

When the 1099-R shows $0 in box 2a

Sometimes the 1099-R will show $0 in the taxable amount. This is rare.

This, in theory, should be the “correct” way to report the taxable amount of the distribution when coupled with the non-deductible contributions (assuming no earnings occurred before distribution).

The “Taxable amount not determined” box MAY be checked or unchecked when the 1099-R shows a $0 in box 2a. This is the custodian levying an opinion on the amount that is taxable. You still need to file form 8606, the 1099-R is simply indicating that the distribution value is 100% basis, or said differently, you have no taxable amount to report on this particular distribution.

😿 Sad Cat received a 1099-R that does NOT have box 2b, left side, checked.

Step 2: Use the 1099-R to complete Form 8606

IRS Form 8606 reports & tracks the details, steps 1 through 4, of the “Backdoor” Roth IRA execution phase above.

It is critical that Form 8606 is correctly and timely filed alongside your Federal Income Tax returns. Failure to file this on time could result in a $50 fee. Failure to report the details properly could result in a $100 fee and unnecessary extra tax liability.

You must file Form 8606 for each spouse if each had nondeductible contributions.

We need the 1099-R to properly complete Form 8606 and Form 1040. Filing it establishes with the IRS that you have a reportable traditional IRA “basis” and how the pro-rata rule applies (if at all) to our Roth IRA conversion. Below is an example 8606 if the “backdoor” Roth IRA strategy is completed perfectly.

Line 1 represents the maximum dollar amount per the IRS limits for the calendar year (changes each year) that a taxpayer can contribute to an IRA. This line is accounting for your current year basis established for the amount of your nondeductible contribution from step 1 in the execution phase of our “Backdoor” Roth IRA strategy, outlined above.

Line 2 represents that you had no “carryover” basis in your IRA from prior years. You should verify that you don’t have a basis from prior years, or in any other pre-tax IRA accounts. It is also a good reminder to keep your 8606 tax forms in your tax records beyond the IRS audit limitation statutes.

Lines 5-13 are the application of the Pro-Rata rule. This is determining how much of your Roth IRA conversion should be taxable.

Remember, we must avoid falling subject to the Pro-Rata rule to properly perform the “backdoor” Roth IRA strategy.

Do not leave any positive values in any Traditional, SEP, or SIMPLE IRA accounts in your name by December 31st of the current calendar year!

Next, we move on to page 2 ⬇️

Page 2 is detailing the “Backdoor” Roth IRA execution step 3, the Roth Conversion.

For the purposes of the “backdoor” Roth IRA strategy, the details reveal that while we are causing a taxable event via the Roth Conversion, it has $0 tax implications because there is no taxable amount. Roth Conversions are one of the exceptions to the 10% early withdrawal penalty for folks under age 59.5, so we don’t need to worry about that either.

😿 Sad Cat contributed directly to a Roth IRA, instead of to a Traditional IRA because it did not realize it was a “high-earner”.

Step 3: Use 8606 to properly File IRS Form 1040

💡 It is easy to mess up the “backdoor” Roth IRA strategy since most people use tax filing software services like TurboTax, Etc. These services APPROXIMATE the actual IRS Forms, so we will need to use the 1040 preview to check our work.

With Form 8606 complete and the 1099-R in hand, we can complete our Federal Tax filing and enter the info on IRS Form 1040.

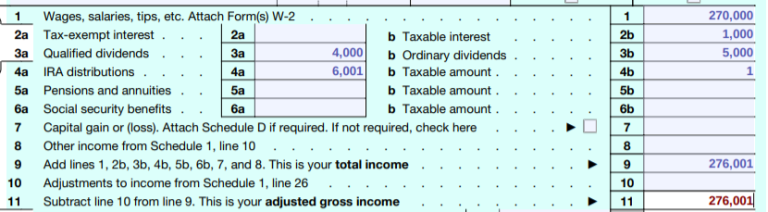

All IRA distributions live on line 4a of IRS Form 1040. Our “backdoor” Roth IRA strategy info will go here along with any other IRA distributions for the calendar year.

The amount that goes on line 4a is Box 1 from the 1099-R associated with the “backdoor” Roth IRA strategy. This should be very close to $6,000 for the calendar year 2022.

Line 4b on IRS Form 1040 is the taxable amount of our IRA distributions. In a perfectly executed “backdoor” Roth IRA this amount would be $0.

Perfection is not the goal.

The goal is to maximize the amount of money we can contribute and grow in our Roth IRA.

So, if there was a small time delay during your “backdoor” Roth IRA strategy execution, cut yourself some slack.

Having an extra $1, $2, hell $700 worth of taxable income is not going to kill anyone, and it certainly won’t erode the benefits you are accruing to your familial wealth by crushing funds into your Roth IRA.

If, however, the taxable amount on line 4b of IRS Form 1040 is $1,000’s of dollars or close to $6,000 then the likeliest explanation is that the tax software you use was not intuitive and you need to double-check how the tax filing software approximated form 8606.

😿 Sad Cat received a 1099-R that does NOT have box 2b, left side, checked.

🎉 You have successfully reported the “Backdoor” Roth IRA Process 🎉

let’s check back in with Sad Cat and see if we can help it fix its mistakes……

Fixing “Backdoor” Roth IRA Process “mistakes”

MaxmyRoth.com does not want you to make the same mistakes as Sad Cat has throughout this process. Below we will cover how to prevent or correct mistakes associated with the “Backdoor” Roth IRA process.

😿 Sad Cat contributed directly to a Roth IRA, instead of to a Traditional IRA because it did not realize it was a “high-earner”.

You will have to do an IRA Recharacterization

😿 Sad Cat did not listen to us & chose to invest in the double-leveraged “Eloncoin” Exchange Traded Fund. It did not know it was coming down with a bad case of food poisoning, leaving it incapacitated for the next 3 weeks & delaying the implementation of step 3.

There are two “mistake” outcomes associated with Sad Cat’s error.

- You had “earnings” – or growth value on top of the non-deductible contribution value.

- You had “losses” – or loss value below the non-deductible contribution value.

😿 Sad Cat got swept up in all the important things cats do in life. Sad Cat forgot to perform the Roth Conversion during the contribution calendar year.

Sad Cat may have (likely small) additional income tax due because of the potential growth value on nondeductible contributions. As long as you follow the “maximized” “backdoor” Roth IRA execution step 2 – this should not be a big deal.

😿 Sad Cat got swept up in all the important things cats do in life. Sad Cat forgot to invest the newly converted $6,000 now inside its Roth IRA.

If the stock market goes down, this may be an opportunity to invest while stocks are low!

Stocks tend to go up, so the more likely outcome is Sad Cat has an opportunity cost associated with sitting on cash for too long. Sad Cat will fix by investing as soon as they realize the “mistake”.

😿 Sad Cat forgot it had an old Vanguard custodied SEP IRA with a $100,000 balance on December 31st in his Roth conversion year.

Sad Cat has a major problem. It could have PREVENTED this mistake – by following the maximized “Backdoor” Roth IRA execution Step 5, but there is no fix for this error because there WAS a SEP IRA value on December 31st.

It is critical that on December 31st, of the conversion year, SEP, SIMPLE, & Traditional IRA balances are zero ❗

Since there is no fix for this, let’s go through how we would have to report it