👀 What if I told you there was a way to save ~10X more Roth dollars using this strategy than its smaller cousin the “backdoor” Roth IRA strategy and double the $22,500 limit on direct Roth 401(k) contributions? Meet the “Mega Backdoor” Roth! A way to save ~$40,000 in Roth dollars each year! In this article we will cover the mechanics of the “Mega backdoor” Roth IRA strategy, WHY you should save into it, and how you implement the strategy with your 401(k)/403(b).

What is the Mega “Backdoor” Roth Strategy?

The “Mega Backdoor” Roth Strategy is a financial hack to save and compound ~$60,000 into “Roth dollars” each and every year!

Why should I do the Mega “Backdoor” Roth IRA Strategy?

It is an accelerant to anyone’s financial independence journey and a major wealth hack!

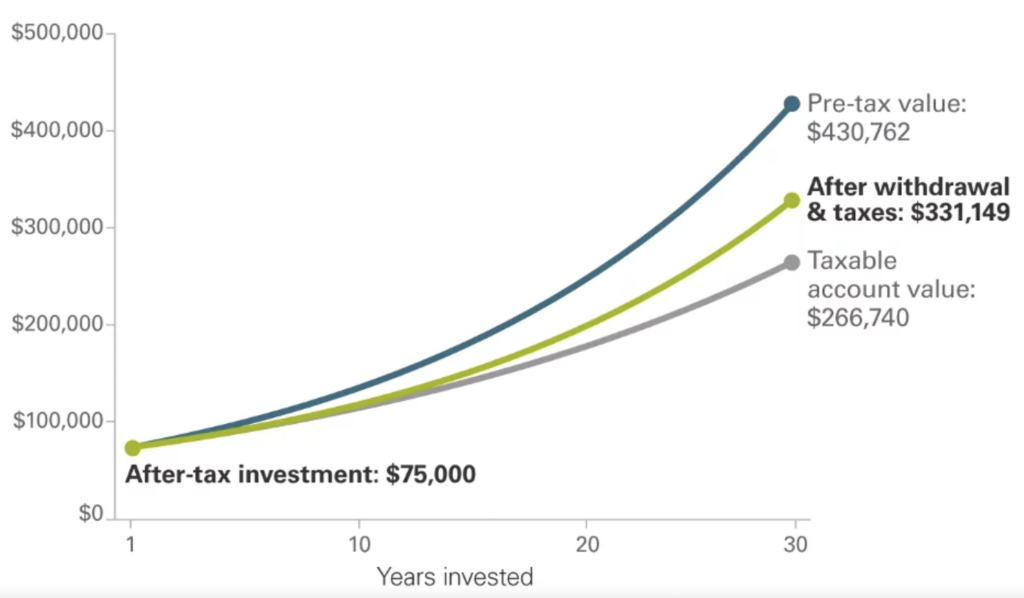

In the example above, a $75,000 investment grows to a final balance after 30 years that is nearly $100k greater with a tax-free account (Roth) than a tax-deferred account (Traditional IRA or 401k) and nearly $170k greater than a taxable account.

While taxable accounts are great, annual turnover with even meager dividends (2%) results in tax-deferred growth being superior to taxable investing. This comparison assumed ordinary tax upon distribution. Roth IRAs are tax-free upon distribution so they are by far the best account to grow wealth in.

What allows for the Mega “Backdoor” Roth IRA Strategy?

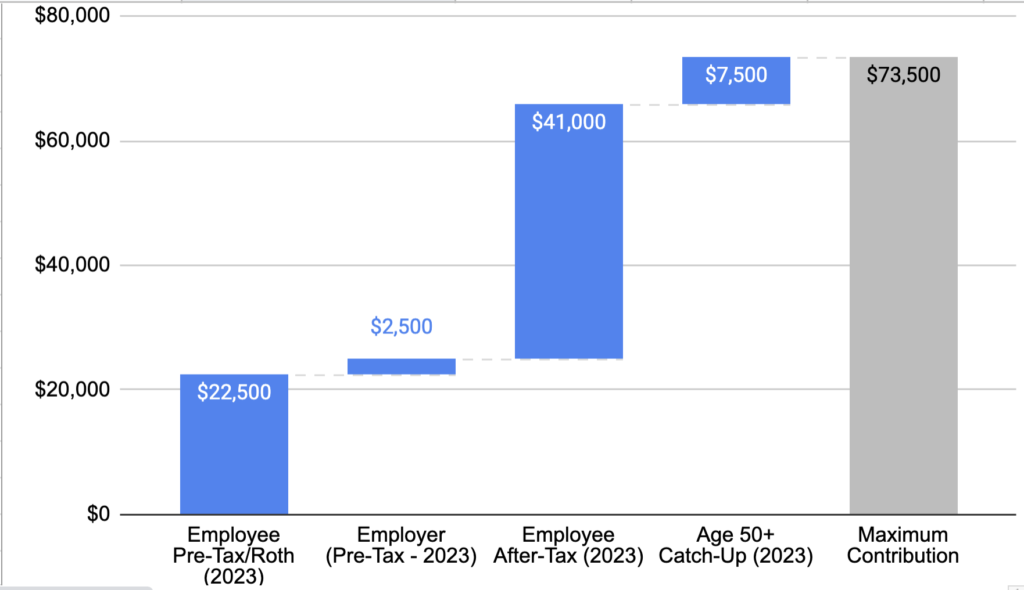

Did you know you can save up to $73,500+ (2023) into a 401(k)?

Uncle Sam wants its tax revenue. It does not want you to have the ability to save unlimited amounts of money to the amazing power of tax-free growth and tax-free distributions.

Just like Individual Retirement Arrangements, 401(k)s and other defined contribution plans, are subject to contribution limits, or an upper limit on the total amount of money that goes into the account per year.

The IRS calls this the Maximum Amount Contributable.

Every 401(k) administrator must maintain records concerning money movements in and out of the plan. Each 401(k) participant (employee) has a sub-account that tracks their money in the overall plan.

Further, each participant will have different “buckets” 🪣 of money accounted for by the 401(k) plan record keeper that represents the type of savings that go into their sub-account.

Each of the buckets 🪣 has specific tax treatment associated with them detailed as we go through each.

Let’s say we want to be super savers and save as much as we possibly can into a 401(k). We need to have ~$60,000+ of personal positive cash flow, each year.

We have multiple savings “buckets” to fill up on our way to the maximum,

Let’s begin……..

🪣 Employee Contributions, Part 1– [$22,500 for 2023]

$22,500 (2023) is what most people are familiar with & thinks is the maximum amount you can contribute to a 401(k)/403(b).

$22,500 (2023) is actually a subset of the maximum amount you can save in a 401(k). It is how much you can annually deduct (divert) from your salary into a 401(k).

Tax Treatment(s):

- Flavor #1 is Pre-tax elective deferrals – where the contributed amount is actually deducted from your salary such that it is not reported on your W-2 as wages and is not subject to income taxes (it is subject to FICA taxes).

- Flavor #2 is After-tax, or Roth, elective deferrals – where the contributed amount is subject to income taxes, but the same salary reduction limits as the pre-tax flavor.

🪣 Employer Contributions – Variable ~ [$2,500 – $15,000]

Employers can also contribute to your 401(k) account.

The most common example of an employer contribution is the “matching contribution”. This amount is dependent on the employer and does NOT count against piece 1 above. Said differently, it stacks on top of piece 1 above.

Some employers may provide a profit-sharing contribution. Think of this as a “we had a great year as a business” bonus contribution.

🤓 Nerd Note:

Employer matching contributions amounts vary widely, typically ranging from $1,500 - $15,000.

- Hubspot, for example, has a maximum cap of $2,500 on the lower end.

- Delta pilots have a union-negotiated, 16% company match! 🤯

The only true limit to employer contributions to a 401(k) is the difference between the annually defined maximum of $66,000 (2023) and your employee contribution maximum of $22,500 (2023) from piece 1 above.

Tax Treatment(s):

Employer matching contributions, and their associated growth, are ALWAYS pre-tax (will be taxed upon distribution or conversion), even if you contribute via Roth elective deferrals (bucket #1, flavor #2).

Voluntary (often called “regular”) after-tax deferrals do not reduce your salary for tax reporting purposes. This means voluntary after-tax elective deferrals are reported on your W-2 as taxable earnings from your employer. They are Post-Tax.

🤓 Nerd Note:

Unlike true Roth IRA dollars saved in bucket #1, the earnings growth associated with regular after-tax contributions (value above principal) is not tax-free upon distribution. We must take action to turn regular after-tax dollars held inside a 401(k) into Roth dollars. If we do not take action, the regular after-tax bucket earnings will be subject to ordinary income tax upon distribution.

Tax Treatment(s):

Regular after-tax deferrals are always post-tax on the way into the 401(k) plan. The tax on the growth of those dollars if maintained

The default tax treatment of regular After-Tax 401(k) contributions is taxed on the way in (post-tax), with distributions separated into growth and basis – or contribution value.

🪣 Employee Contributions – BONUS – [$7,500] (2023)

Unlike all preceding components, Age 50+ catch-up contributions are NOT a subcomponent of the maximum amount contributable. Said another way, age 50+ contributions INCREASE the maximum amount contributable beyond the annual additions limit.

Tax Treatment(s):

Age 50+ catch-up contributions can be saved either as Roth dollars or Pre-Tax dollars depending on your preferred tax treatment.

Add all these up = $73,500(2023) of potential tax preferential savings with ~$63,000 of it being tax-free growth & tax-free distribution Roth dollars. But before you get excited let’s make sure you can do this…….

Who is the Mega “Backdoor” Roth IRA Strategy for?

🤓 Nerd Note: According to Vanguard, 21% of Defined Contribution plans (401(k)/403(b) offer the ability to contribute voluntary after-tax dollars. ICI estimates there are 600,000 401(k)s in the country, covering 60 million active participants. This means a potential 12.6 million people are eligible to use this strategy!

Any individual in the employment status groups below,

🐝 “Day Job” W-2 worker bee

👷♀️ Solo (or Solo + Spouse) Self-Employed Business Owner

🧑🏭 Self-Employed Business Owner with non-spousal employees

🐝 A “Day Job” employee + 👷♀️ with a “side-hustle” Solo Self-Employed Business

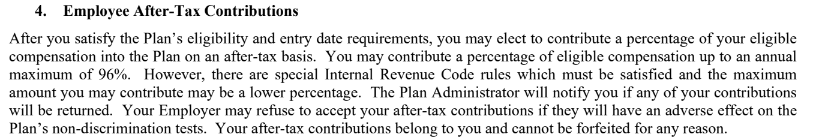

AND verifies their 401(k), 403(b), or 457 has the after-tax 401(k) “bucket” available:

Let’s see how each employment status group can verify they have access to the “mega backdoor” Roth IRA Strategy:

How do I verify my 401(k) has the after-tax bucket?

🐝 – “Day Job” W-2 worker bee:

A quick hack would be to check out our ever-expanding, maxmyRoth, crowd-sourced database!

Otherwise, you need to get your hands on your employer 401(k) Summary Plan Description, or SPD for short. This document details all the rules that govern your 401(k) plan, as designed by your employer and 401(k) plan sponsor. Things like when the money you contribute is entirely yours (vesting schedules), how & when you can distribute funds, rollover provisions, etc.

- To obtain your Summary Plan Description(SPD) you can do one of two things.

- Email/slack your HR or People team and ask for the PDF.

- Log in to your 401k account at Vanguard, Fidelity, Etc. and look for a link that says “plan details”…there you should find a heading for Summary Plan Description.

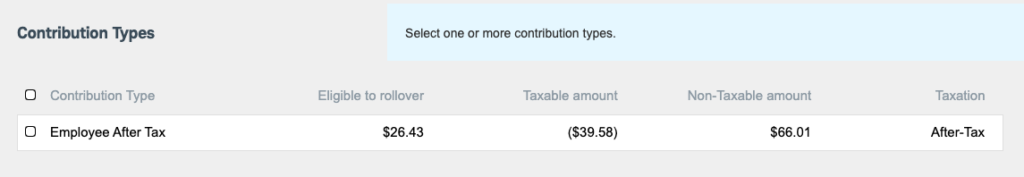

Buried in the SPD will be a “contribution types” section that will list 1 or more of the 4 savings “buckets” we described above. You are looking for something similar to this 👇

What if I don’t see this language in my 401(k) SPD?

The wealth-creating power potential of this strategy is too good to give up straight away. Try this……

Either on your own, with your financial advisor, or with a cohort of fellow employees, send this letter to your head HR or people team person. There is power in numbers.

It may seem like a hail Mary, but it works. I have helped effect change to add voluntary after-tax contributions at several companies. Part of the goal of this site is to make this more widely available.

👷♀️ Solo (or Solo + Spouse) Self-Employed Business Owner:

If you are a Solo (or Solo + Spouse) Self-Employed Business Owner, you will need to get your hands on your 401(k) Summary Plan Description.

You are the Employer and Employee so you should have this in your records when you created your Solo-401(k). If you don’t have it, log in to your Solo-401(k) account and see if it is in the Plan Documents section of the website. Or, contact the plan provider you used to set it up.

What if I don’t see this language in my Individual 401(k) SPD?

The bad news is your current Individual 401(k) plan provider (Vanguard, Etc.) is likely using a “Prototype” 401(k) plan governing document. This is a basic 401(k) plan that typically offers limited features and likely does not include the voluntary after-tax contribution provisions you need.

Further, your current 401(k) plan provider may not offer the ability to add the voluntary after-tax contribution provisions you need to execute the “mega backdoor” Roth IRA Strategy.

The good news is it is possible to add these provisions by switching 401(k) plan providers, using an organization that offers a more customized 401(k) plan design. Some options that provide more customized plan designs are mysolo401k.net, solo401k.com, etc.

This will likely involve rolling over your plan asset account(s) – sub-account(s). Talk with the provider to fully understand the implications of performing this rollover, as well as the ongoing record-keeping changes that might occur.

Executing the “Mega Backdoor” Roth IRA Process – W2 Employee

😿 Meet Sad Cat. Sad Cat has made some errors during the “Mega Backdoor” Roth IRA process. Look for Sad Cat as we move through the steps so you can avoid the errors it makes. We will help fix Sad Cat’s errors at the end of this article.

Step 1: Make Voluntary After-Tax Payroll Deductions

🤓 Nerd Note: When you participate in your Company 401(k) you make elections for how you want the dollars contributed via deductions from your paycheck to be invested. You do this for “Current Allocations” - this would change the investment makeup of any dollars already in your 401(k). You also do this for “Future Allocations” - this would be a change to the investment makeup of dollars coming into the 401(k). This will be important when choosing your execution transfer strategy.

Your 401(k) contributions will be made by electing to “deduct” contributions from your paycheck. Typically you can choose the amount that will come out of each 24/26 week paycheck by dollar value or percentage. If you are reading this you have likely already done this. You probably just chose between Employee Pre-Tax and Employee-Roth contributions.

How you elect to make employee after-tax contributions will look different by the employer and among the 401k plan providers (Fidelity, Vanguard, Etc.) I have included an image of the election process for a 401(k) plan provided by Vanguard.

Notice that the image above represents 2 of the 4 “buckets” we need to become super savers and max out our 401(k). The two buckets are the Employee contribution part 1 bucket (elective deferrals) and the Employee contribution part 2 bucket (voluntary after-tax).

Further, it’s important to note that the 401(k) provider “tracks” all of the various buckets for proper tax reporting. In fact, “buckets” is describing real sub-accounts within the overall participant 401(k) account held for an employee.

😿 Sad Cat has not elected any dollar amount into its after-tax contribution “bucket”. Sad Cat could be tax preferentially saving tens of thousands of extra dollars per year using this 401(k) option.

👉 PRO TIP: A note about timing. Many Roth fans will accelerate their 401(k) contributions by consuming their entire first few paychecks as their regular after-tax contributions. They do this because they understand that most of the time, stocks go up, and the quicker they contribute and invest those dollars, the quicker it will grow. You want to be careful about this because doing so can lead to missing out on the full company match as employers contribute on a pro-rata pay period basis regardless of your actual contributions. Some employers offer a “True-Up” provision to ensure this does not happen. You can ask your employer to do the same, but if they don’t, or won’t, don’t contribute too quickly & miss the “free money” from the full match.

Step 2: Identify & Perform the applicable after-tax ➡️ Roth transfer:

- Voluntary after-tax contributions ➡️ in-plan Roth conversion (or in-plan Roth Rollover) to Roth 401k.

- Voluntary after-tax contributions ➡️ in-service distribution to Roth IRA.

Your 401(k) may contain one, or both, of these options.

Let’s break down each after-tax ➡️ Roth transfer option with some examples and Pros and Cons.

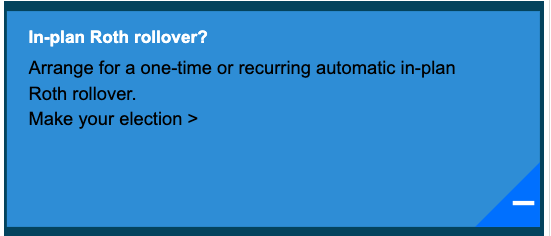

Voluntary after-tax contributions ➡️ in-plan Roth conversion (or in-plan Roth Rollover) to Roth 401k.

In-Plan Roth Conversion:

This is increasingly becoming the primary option employers choose to offer their employees. Importantly, in this option funds stay within the 401(k) plan.

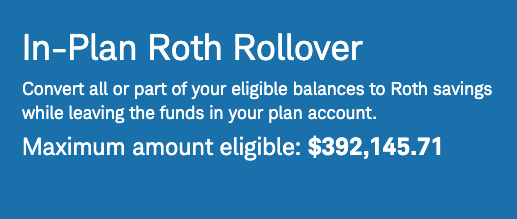

Above is a Vanguard 401(k) plan’s option for an in-plan Roth conversion set-up.

For our purposes, you want to use the option to “Set up auto Roth conversions” on the left of the above image.

This will take each after-tax paycheck contribution & immediately convert the after-tax dollars into Roth dollars. This SHOULD place the dollars into a special tracked category of money called “after-tax Roth Conversion dollars”. These dollars remain in the 401k plan available for withdrawal of contributions after the 401(k) 5-year rule is satisfied.

In-Plan Roth Rollover:

Let’s take a look at a 401(k) employer plan, administered by Charles Schwab, which accomplishes the “mega backdoor” strategy but calls it an In-Plan Roth Rollover.

👉 PRO TIP: Notice in the three boxes above you have two real choices. You can manually “convert” after-tax dollars ad-hoc, or you can let the plan administrator perform it instantly & automatically for you. It is recommended you do this automatically to reduce any possibility of creating an unnecessary tax liability.

PROs:

- In-Plan Roth conversions/rollovers allow all earnings growth associated with your regular after-tax contributions to grow fully tax-free upon qualifying withdrawal.

- It avoids generating any income tax on the earnings growth of the converted after-tax dollars.

- Many 401(k) providers (Schwab, Fidelity, Vanguard) are allowing 401(k) funds to be moved internally to a “Brokerage-Linked” account. This gives folks like you the opportunity to invest in damn near everything you would with a personal Roth IRA brokerage account.

CONs:

- Converted funds in a designated Roth 401(k) account ARE SUBJECT to Required Minimum distribution rules, unlike Roth IRA funds.

- Funds converted to the designated Roth 401(k) account may not be eligible to be rolled over to a personal Roth IRA depending on how your 401(k) is set up with the plan administrator. This means these funds are fairly illiquid until around age 59.5 unless your employer allows for a rollover of the designated Roth 401(k) account – which is becoming more common.

- Each employer-provided (including Self-Employed Solo) 401(k) is subject to its own 5-year “marination” rule. However, if you are switching employers and the balance of one Roth 401(k) is rolled into another Roth 401(k)the 5-year period is based on whichever plan has been around longer (the original plan OR the new one being rolled into).

- Example: You work for Boeing & have had an eligible 401(k) Roth account since 2015, all funds are eligible for qualified distributions assuming you also meet the age 59.5 or disabled requirement.

- Example: You work for Salesforce and have had an eligible 401(k) Roth account since 2020 (and it is the only 401(k) you have ever had), all funds are NOT eligible for qualified distributions even if you are over the age of 59.5, or disabled, because you do not meet the 5-year “marination” rule.

- Example: You work for Salesforce and have had an eligible 401(k) Roth account since 2020. You also have an old 401(k) with your previous employer, Boeing, that had a designated Roth account established in January 2017. If you are older than 59.5, or disabled, you can make a qualified distribution from your Boeing 401(k) directly since it meets the five-year rule. You can also make qualified distributions from your Salesforce 401(k) if you roll over your Boeing funds into the Salesforce 401(k) since the established date carries over. Be sure to alert the new plan administrator of the previous designated Roth account start date.

🤓 Nerd Note: Some tips to establish a 5-year aged designated Roth 401(k) account: - Make Roth contributions for one paycheck as early as possible even if you want exposure to pre- tax contributions because of high current income. - Roll over the Roth 401(k) funds into a Roth IRA that has met the Roth IRA 5-year rule. - If you qualify, establish a self-employed Solo-K as early as you can as this can always be a receiving account, that itself, meets the designated Roth 401(k) 5-year rule. </aside>

😿 Sad Cat accidentally chose to “convert now” and make a one-time conversion. Instead of converting after-tax dollars it is converting pre-tax dollars and will owe income tax on the entire amount in the current year.

Voluntary after-tax contributions ➡️ in-service distribution to Roth IRA.

This option changes the final LOCATION of your regular after-tax contributions from your 401(k) to your personal Roth IRA. Your 401(k) must allow for in-service distributions of your regular after-tax contributions for your age(not all do).

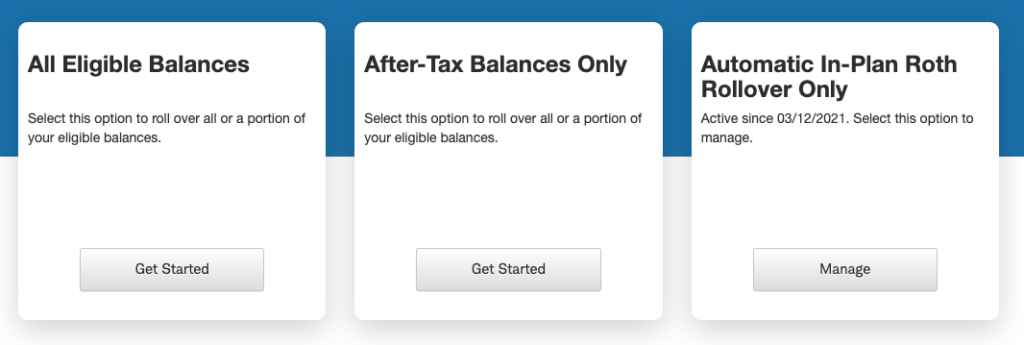

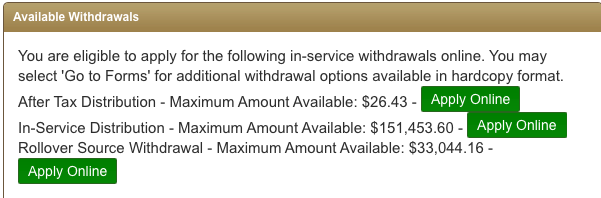

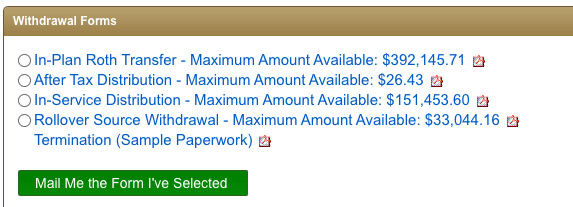

Below is a Charles Schwab 401(k) plan’s option for an in-service regular after-tax distribution.

You will be selecting “After Tax Distribution” as we only want to distribute this portion out of the 401(k) plan into our personal Roth IRA.

This will distribute the accumulated regular after-tax contributions you have made up until the moment of the physical money movement when executing the rollover process. Earnings growth on the regular after-tax contribution (basis) value is also distributed. There is no way to distribute only the contribution (basis) value, but you can split the earnings and contribution (basis) value out (in many cases).

As you can see below you can only select the Employee After Tax bucket. The record keeper is dictating what amount of your accumulated regular after-tax dollars will be taxable IF you distribute these dollars directly to yourself.

Once you complete and submit the corresponding paperwork/or online form (do this with the help of a qualified financial or tax professional) your funds will be distributed in about a week’s time.

👉 PRO TIP: You must fill out the in-service distribution paperwork ensuring the rollover checks are made payable to your Roth IRA custodian for your personal benefit (FBO your name). This ensures the distribution can complete a direct rollover which can be completed an unlimited number of times per year versus an indirect rollover which can only be completed once per year. Alternatively, many custodians, like Charles Schwab, will complete this process very seamlessly for you as long as you keep the money internally at Schwab - despite it moving from a 401(k) to your personal IRAs. Talk to their retirement plan specialists to have them do this for you. Once the internal transfer from 401(k) to IRAs is complete, you can move the IRAs to your preferred custodian if different.

PROs:

- It allows all earnings growth associated with the dollars rolled over to your personal Roth IRA to grow fully tax-free upon qualifying withdrawal.

- If performed perfectly, earnings growth can be rolled over to a Traditional IRA & the contributions (basis) can be rolled over to a Roth IRA with no unnecessary tax liability generated.

- You have the full range of investment choices available via a brokerage account tied to your personal Roth IRA at the custodian of your choice.

- Because the funds ultimately end up in your personal Roth IRA as long as that Roth IRA has had dollars in it for 5 years, you can distribute the contribution values with NO penalty or tax providing a supersized “emergency fund”.

CONs:

- Some plan administrators will not issue separate checks for the earnings growth & the basis of the regular after-tax money. This causes tax reporting complexities (detailed at the bottom of this article).

- There is a chance you will owe income tax on the nominal growth amount above the value of the after-tax contributions because of a time delay between contributing to the 401(k) & processing the rollover to the personal Roth IRA.

- This method is more administratively burdensome, creating the opportunity for more potential errors.

🎉 You have successfully executed the “Mega Backdoor” Roth Process 🎉

unfortunately, now you have to report execution steps 1 & 2 to the IRS, or you might be paying lots of extra unnecessary tax!…….

Tax Reporting for the “Mega Backdoor” Roth IRA Process

Come April 15th you will be preparing your tax returns for the previous calendar year. You are, just now, reporting a process you “finished” many months earlier (less if you made mistakes along the way)! It is no wonder many folks mess this entire strategy up. I can’t remember much from last week, let alone over a year ago!

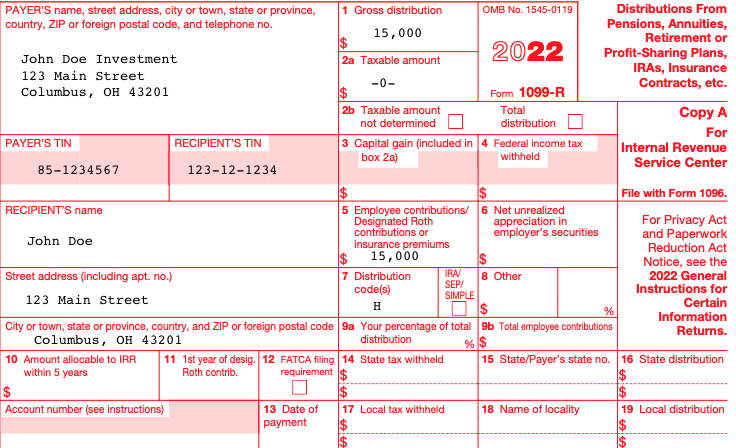

Step 1: Obtain Form 1099-R from your IRA Custodian/Trustee

These are usually issued in February of the year following your contribution year. They will come from the custodian/plan administrator of the 401(k) plan.

The IRS requires IRA Custodian/Trustees to fill out & send form 1099-R by January 31 in the year following distributions of $10 or more.

Your current Tax Filing Year “Mega Backdoor” Roth Conversion/Rollover will generate a Form 1099-R from the custodian where your regular after-tax contributions were deposited (Fidelity, Etc.). You should be able to download a copy online. Many Trustees still physically mail these bad boys.

Form 1099-R, box 1, will report a gross distribution of approximately $37,000 (the amount of the total Roth conversion/rollover). The above example assumes the execution steps of the “Mega Backdoor” Roth strategy were done in the “maximized” way.

Form 1099-R, box 2a, is where the taxable amount of the retirement plan distribution is listed from the perspective of the custodian of the account (Fidelity, Etc.).

🤓 Nerd Note:

Sometimes these 1099-Rs are issued incorrectly (nobody’s perfect). You may need to contact the custodian or plan administrator to correct the issue.

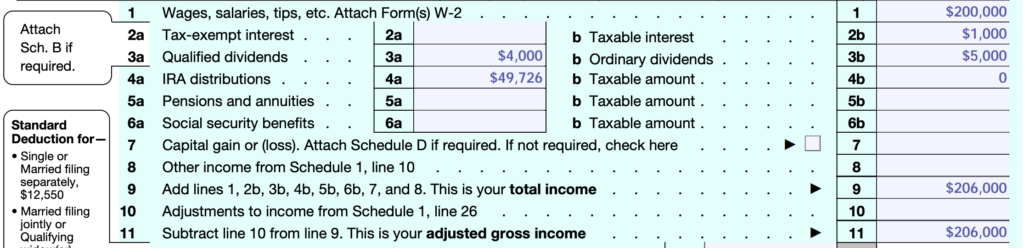

Step 2: Properly complete your Federal Income Tax by using the 1099-R

With the 1099-R in hand, we can complete our Federal Tax filing & enter the info on IRS Form 1040.

All retirement plan account distributions live on line 4a of IRS Form 1040. Our “mega backdoor” Roth strategy info will go here along with any other IRA distributions for the prior calendar year.

The amount that goes on line 4a is Box 1 from the 1099-R associated with the “mega backdoor” Roth strategy. If you are aiming for maximum Roth dollar exposure, this should be something close to $37,000 for the calendar year 2022.

Line 4b on IRS Form 1040 is the taxable amount of our retirement plan account distributions. In a perfectly executed “mega backdoor” Roth strategy, this amount would be $0.

🎉 You have successfully reported the “Mega Backdoor” Roth Process 🎉

let’s check back in with Sad Cat and see if we can help it fix its mistakes……

Fixing “Mega Backdoor” Roth Process “mistakes”

MaxmyRoth.com does not want you to make the same mistakes as Sad Cat has throughout this process. Below we will cover how to prevent or correct mistakes associated with the “Mega Backdoor” Roth process.